CPF: The Singaporean Social Security Fund

If you have lived in Singapore or are currently residing here, chances are high that you have come across the term “CPF” in conversations with your coworkers or Singaporean friends.

For those intending to become Permanent Residents (PRs) or Citizens of Singapore, it is essential to know about the Central Provident Fund (CPF). The CPF is a huge part of the average Singaporean’s financial planning and is an important concept to understand. This is especially so for business owners who intend to establish their businesses here in Singapore, because CPF contributions are also part of an employer’s duties.

In essence, the CPF is Singapore’s version of social security, and is a national retirement savings scheme for working residents of Singapore. This fund is generally used to offset the costs of housing and healthcare, and a portion of it is also used for retirement pension. In the CPF account, interest is earned at a special rate higher than that of most commercial banks. Thus, many Singaporean residents think of the CPF as a safe and efficient way to financially prepare for the future, and to safeguard against emergency expenses like medical bills.

The CPF account is available to Singapore Citizens and Singapore Permanent Residents (PRs) only.

PRs need to start contributing to their CPF on the date of acceptance of their residency status. In their first and second year, PRs are expected to contribute a higher percentage, which will abate in their third year. This amount can be calculated using the CPF Board’s CPF Calculator.

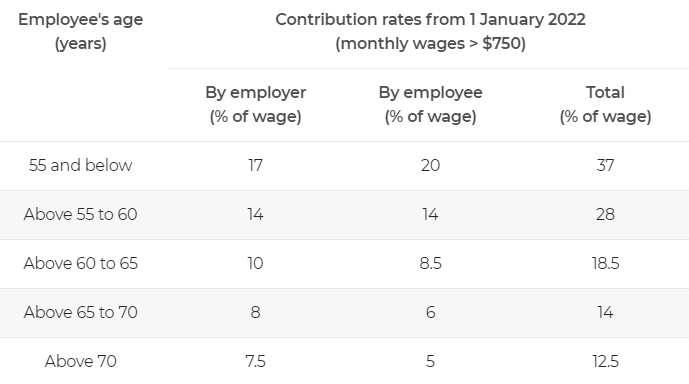

Residents have the option to contribute additional amounts to their CPF account, but the bulk of CPF contributions come from mandatory contributions. Currently, 37% of one’s gross wages (for employees age 55 and below) is contributed to the CPF monthly. 20% of the contribution comes from the employee’s wages, and 17% is contributed by employers. The amount is capped at a salary of SGD 6,000 and is automatically deducted from the employee’s salary. The employer is expected to handle the calculation and submission of CPF contributions for their employees.

Below is a table detailing the CPF contribution breakdown. CPF contribution percentages change according to the age group and wage band of employees, ensuring that the savings plan does not become cumbersome for residents in lower wage groups.

https://www.cpf.gov.sg/employer/employer-obligations/how-much-cpf-contributions-to-pay. For more details, please visit the website.

For Employees

As you work and make CPF contributions, you accumulate savings in these three accounts: your Ordinary Account (OA), MediSave Account (MA), and Special Account (SA). TIn general, the interest rate for your CPF account can go up to a maximum of 5% per annum.

Your OA is most popularly used for housing payments. Many citizens use their OA to buy a property (usually a HDB flat), or they use it to service a housing loan. CPF savings from the OA can also be used for mortgage payments in times of emergency. Alternatively, OA savings can be used to finance your child’s education, or for insurance and investments. It is also used for the Dependents’ Protection Scheme, a type of term life insurance scheme.

The MediSave Account is a savings scheme specifically for medical expenses. These savings can be used for your own and your dependants’ hospitalisation, day surgery, and certain outpatient expenses. They can also be used to pay yearly premiums on approved insurance plans, including those for the government-mandated MediShield Life. For more details on the specific expenses deductible to the MA, please refer to the MOH Website.

As for the Special Account, the CPF SA is a savings account meant specifically for retirement savings and investment. The SA Account enjoys a higher interest rate than the other accounts, and you may also wish to consider using your SA funds to invest in other investment options, from the two main CPF Investment Schemes. This is to ensure that each resident is able to maintain a sum of retirement money.

At age 55, a Retirement Account (RA) is created for you. At this time, your CPF interest can increase to a maximum of 6% per annum. Once you have an RA, you may withdraw your CPF savings at any time and without restrictions on the amount. After age 65, you can also apply to start receiving lifelong monthly payouts using your RA savings.

For more information on the CPF and how to best utilise it, the CPF Board has compiled a number of articles and educational resources on its website here. The resources will be useful in guiding you on how you can use your CPF savings.

For Employers

Before setting up your company in SIngapore, it would be worthwhile to take a look at the CPF Board’s Employers’ Guide. Employers are expected to apply for a CPF Submission Number (CSN) with CPF in order to make CPF contributions.

As mentioned earlier, the CPF contribution rate depends on a variety of factors. You will have to calculate the CPF rates for different employees according to Citizenship status, age group, wage band, and their respe ctive wage ceilings in CPF. To ensure an accurate CPF contribution, you may make use of the CPF Board’s Calculators.

For the employer, it is also important to note that the CPF contribution is due on the last day of the calendar month. This payment can be made through multiple avenues: Direct Debit, Paynow QR, or eNets. For more details, please see the CPF’s Payment modes page

Ultimately, the CPF is an integral part of life in Singapore, whether for business owners or for those who intend to apply for PR and Citizenship. PRs and Citizens are eligible for many benefits tied to their CPF accounts, and some will make full use of their CPF account in financial planning. Business owners are expected to comply with CPF regulations with regards to their employees’ salaries. Knowing how the CPF works will definitely be beneficial to your understanding of local life in Singapore, no matter if you are a business owner or an employee.

– Written by: Asahi Yip, Cayman Management Consultants

#sgexpats #expatlife #expatsingapore #singaporeimmigration #caymangh #xignam #citizenship #singaporecitizen #singaporePR #PermanentResident #cpf #CentralProvidentFund #cpfcalculator #cpfcalculatorforPR #cpfcontributionfirstyearPR #cpfcontributionfornewPR #cpfcontributionforPR #cpfcontributionrateforPR

References:

https://wise.com/sg/blog/cpf-contribution-rate

https://dollarsandsense.sg/guide-cpf-new-permanent-residents-singapore-need-know/